Shale extraction of oil and gas has lessened the need for the United States to import, helping the economy immensely in the form of investment, jobs, and growth. Oil exploration and production remain to be one of the most essential industries in America’s economy. Today, let us delve deeper into the impact of oil prices on the economy.

The price of doing oil business

The United States is one of the top oil-producing countries. Oil price affects the costs of manufacturing and production across the country. For instance, there is a direct relationship between airplane fuel and gasoline to the price of transporting people and goods. A fuel price drop can potentially lower transport costs. Cheaper oil prices benefit the manufacturing sector, as the majority of industrial chemicals are derived from oil.

Before the resurgence in America’s oil production, drops in the price of oil were often viewed as positive for the domestic economy as it would typically reduce the costs for the transportation and manufacturing sectors. These cost reductions are theoretically passed on to the everyday consumer. However, since the U.S. has boosted its oil production, lower oil prices can affect domestic oil industry workers and may reduce revenue & economic productivity for U.S. companies.

Increases in oil prices can increase costs for specific industries & economic functions. These costs are potentially passed on to other businesses and consumers depending on the industry. Examples can include an increase in price of shipping for new furniture from overseas, more expensive airline tickets, or the costs of apples shipped from a different state. An increase in oil prices can mean a rise in prices for seemingly unrelated goods or services.

contact dw energy

Want to learn more about oil & gas investing? Our expert team can provide you with more information or schedule a consultation to talk about diversifying your investment portfolio.

Investment dollars and job growth

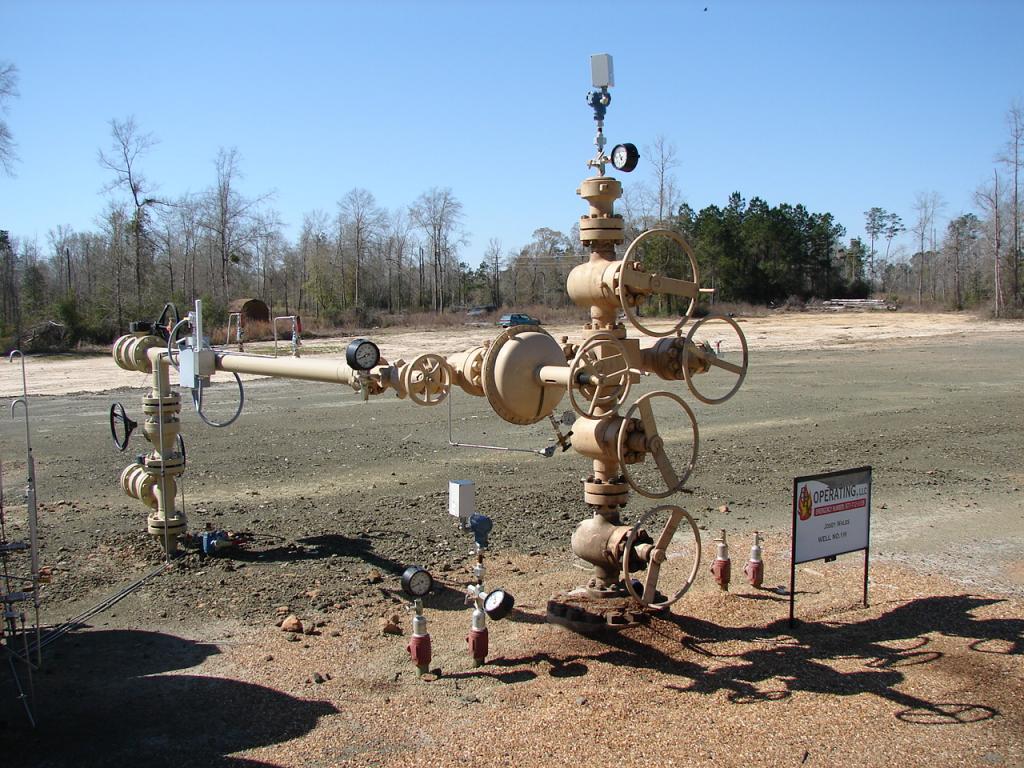

The oil and gas industry has long been a strong source of employment growth. Oil exploration and production require loader operators, drilling crews, diesel mechanics, truck drivers, etc. In turn, people who work in the oil industry support surrounding businesses such as car dealerships, hotels, and restaurants. A decrease in drilling and exploration can lead to layoffs, which can affect local businesses that catered to the industry and its workers.

The investment and banking sectors are also affected when U.S. oil prices decrease. Many companies finance their operations by taking on debt and raising capital. Of course, investors and bankers are well-versed in terms of rewards and risks. However, once there is a dip in oil prices, the losses tend to destroy capital, and will affect the growth of the overall economy.

Advantages of diversity

Thankfully, the U.S. economy is wonderfully diverse. Compared to other oil-producing countries, the American economy is not nearly as tied to oil prices. The U.S. economy can adapt to long periods of oil price fluctuations, but the impact of oil prices on the economy can still be felt — it is not uncommon for changes in oil prices to affect the economy. High oil prices can hit both consumers and businesses with higher manufacturing and transportation costs, but it can also drive investment and job creation as it becomes feasible for oil companies to take advantage of the high prices of shale oil deposits.

Contact dw energy

Sources:

“The United States is now the largest global crude oil producer,” EIA, https://www.eia.gov/todayinenergy/detail.php?id=37053

“Who Benefits from Local Oil and Gas Employment? Labor Market Composition in the Oil and Gas Industry in Texas,” http://ftp.iza.org/dp12349.pdf